This post is designed to understand What Is DeFi?

- Introduce DeFi in plain English

- Explain how it’s different from traditional finance

- Cover popular DeFi applications like lending, staking, and DEXs

- Highlight risks, rewards, and how to get started

- Link to wallets and security guides for context

🌐 What Is DeFi?

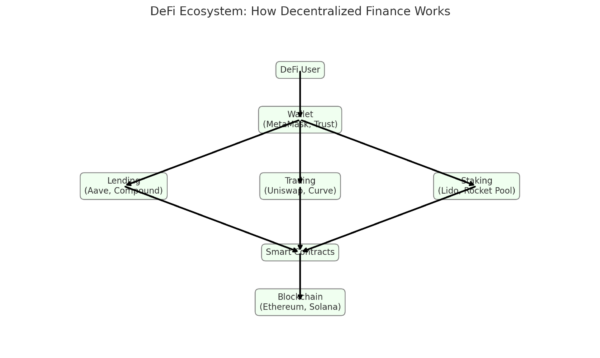

What Is DeFi?, DeFi (Decentralized Finance) refers to a new financial system built on blockchain technology — one that removes traditional banks, brokers, and middlemen from activities like lending, borrowing, and trading.

Everything runs on smart contracts, not institutions. You interact with protocols — not people.

💡 In Simple Terms:

DeFi is like an open-source version of banking — but anyone can access it, use it, and even build on top of it — from anywhere in the world.

🔄 How Does DeFi Work?

DeFi platforms are built mostly on Ethereum and other smart contract blockchains. These platforms use code (smart contracts) to automate:

- Lending (you earn interest)

- Borrowing (you use crypto as collateral)

- Trading (on decentralized exchanges like Uniswap)

- Staking and Yield Farming (earn rewards for helping run the network)

All without needing a bank account, credit check, or approval.

🏦 DeFi vs Traditional Finance (TradFi)

| Feature | Traditional Finance | DeFi |

|---|---|---|

| Control | Banks, institutions | You, the user |

| Access | Limited by region, credit | Open to anyone with a wallet |

| Intermediaries | Required | None |

| Transparency | Limited | 100% open-source and on-chain |

| Fees | Often high, hidden | Usually lower, transparent |

| Risks | Bank risk, policy changes | Smart contract bugs, volatility |

🔗 Popular DeFi Platforms

| Platform | Use Case | Network |

|---|---|---|

| Uniswap | Decentralized exchange | Ethereum |

| Aave | Lending and borrowing | Ethereum, Polygon |

| Compound | Interest markets | Ethereum |

| Curve Finance | Stablecoin trading | Ethereum |

| Lido | Liquid staking | Ethereum |

💸 What Can You Do With DeFi?

1. Earn Interest

Deposit crypto like USDC or ETH and earn yields from borrowers.

2. Borrow Instantly

Use your crypto as collateral to borrow another asset — no credit checks.

3. Trade Tokens

Use decentralized exchanges (DEXs) to swap tokens directly from your wallet.

4. Stake Your Crypto

Lock up your tokens to help secure a network and earn staking rewards.

5. Participate in DAOs

Own governance tokens and vote on how DeFi protocols evolve.

⚠️ Risks to Know Before Using DeFi

- Smart contract bugs – Code can fail or be exploited

- Impermanent loss – Affects liquidity providers in volatile markets

- Rug pulls/scams – Always research protocols before investing

- High gas fees – Especially on Ethereum during peak times

- Lack of regulation – You have fewer protections than traditional banking

✅ Getting Started with DeFi

- Get a wallet – e.g., MetaMask or Trust Wallet

- Buy crypto – Start with ETH or stablecoins like USDC

- Connect to a DeFi protocol – Go to the official site (e.g., Aave, Uniswap)

- Approve transactions – Your wallet will prompt you

- Monitor your position – Keep an eye on yields, collateral ratios, and protocol changes

⚠️ Tip: Always use the official URLs — phishing is common in DeFi.

🔗 Related Guides:

- 👉 What Is a Crypto Wallet? Hot vs Cold Explained

- 👉 How to Buy Crypto in the UK

- 👉 Smart Contracts Explained (Coming Soon)

🧠 Final Thoughts

DeFi opens up a world of financial possibilities without relying on banks or borders — but it comes with risks and a steep learning curve. Always start small, use secure wallets, and research every protocol you engage with.

If you’re ready to explore the next frontier of finance — DeFi might just be your gateway.